Technology and automation have made lives easier for financial service providers. They can use software to achieve tasks in minutes that would normally take days. Technology also lets financial businesses automate repetitive tasks and improve efficiency. And in today’s competitive landscape, Australian financial businesses have everything to gain from implementing business process automation.

What is Business Process Automation?

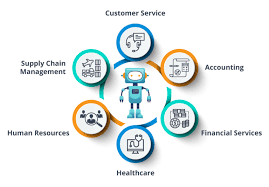

Business Process Automation (BPA) is the use of technology to automate repetitive tasks. The benefits of automating repetitive tasks include improved efficiency, reduced costs, and improved workflows. In the financial industry, BPA can be applied to diverse services, including insurance, banking, and investment management.

Australia’s small to medium financial service providers benefit greatly from BPA because it increases productivity. Financial businesses use BPA for data entry, marketing, customer service, and payment processing. The biggest benefit of BPA is that it frees your employees to focus on strategic, value-adding activities.

Tasks that can be automated in Finance Industry

These four tasks can be easily automated with BPA.

Data entry and record keeping

BPA improves the efficiency and accuracy of data recording. BPA minimises the time spent in recording data and eliminates human error through the following features:

- Automatic data entry: Optical Character Recognition (OCR) and Natural Language Processing (NLP) can instantly extract information from documents, images, and other files.

- Data validation: BPA validates data when it’s entered, ensuring only consistent and accurate information is recorded.

- Systems integration: You can integrate BPA with other organisational systems, including CRMs, ERPs, and accounting platforms, which lets you seamlessly exchange data.

- Data standardisation and transformation: BPA can standardise data transformation processes like currency conversion and date/time adjustment.

- Record management: BPA provides easy access and maintenance of records.

- Audit trails and compliance: Automated records create easily accessible audit trails that improve data integrity and compliance.

Essentially, BPA drastically improves the efficiency and accuracy of data recording tasks, which are otherwise time-consuming and prone to human error.

Customer Service

BPA improves customer service by reducing response times and streamlining customer service processes. Financial institutions can automate routine tasks with BPA to improve customer service in the following ways:

- Chatbots and virtual assistance: Chatbots and virtual assistants let you quickly deliver relevant responses to common customer enquiries. Financial institutions can also integrate BPA with their communication channels, like social media and email, to provide real-time responses outside of business hours.

- Automated notifications: Financial institutions can use BPA to send automated notifications and alerts about account activities and other payment information. This way, they’ll keep customers informed and engaged.

- Personalised experience: Financial businesses can use customer data and AI-driven analytics to provide personalised experiences and recommendations.

- Streamlined account opening: BPA automates aspects of account opening like identity verification and account setup. The result is a smoother and faster account opening experience.

- Faster issue resolution: BPA automates tracking and resolving customer issues, improving response times and increasing customer satisfaction.

- Self-service options: Financial institution portals powered by BPA let customers access account information and update personal details without human assistance.

Marketing

Financial service businesses can use BPA to improve marketing activities by automating outreach, engagement, and targeting tasks. Financial businesses can achieve this through the following ways:

- Customer segmentation and targeting: Financial businesses can segment customers around demographic and other criteria like financial behaviour. This market segmentation lets financial businesses more effectively target different market segments.

- Personalised marketing campaigns: AI-driven analytics lets financial businesses create personalised marketing content that’s tailored to individual preferences and needs. The result is more effective marketing campaigns.

- Automated email tracking: BPA can automate email marketing by sending targeted emails to potential customers. The result is fewer resources spent on marketing content that performs better.

- Social media management: Financial businesses can use BPA tools to automate social media posting, scheduling, and monitoring to maintain a consistent and engaging presence with their customers.

- Lead nurturing and scoring: BPA allows financial businesses to send targeted content to potential customers and prioritise leads based on the likelihood of conversion. This allows businesses to focus on high-value prospects.

- Performance tracking and reporting: You can use BPA to automate data tracking, analysis and reporting. This way, you will receive better quality information faster, which you can use for data-driven decision-making.

- Content marketing: BPA helps in the content creation and distribution processes. You can also use it to monitor the performance of your content and ensure your organisation maintains high internet search visibility.

- Marketing automation platforms: Financial businesses can integrate marketing automation platforms to integrate different marketing tasks like email marketing, social media marketing, and lead nurturing to streamline work and analyse campaign performance.

Payment processing and reconciliation

Payment processing and reconciliation are both important activities for financial businesses. BPA helps streamline both, reducing errors and improving efficiency in the following ways:

- Faster payment processing: BPA can automate incoming and outgoing payment processing, which removes the need for human intervention. The result is a faster payment cycle that ensures on-time payments and a better vendor and customer relationship.

- Improve accuracy: Automated payment processing almost completely eliminates human error during data entry and calculation. So financial institutions create better records, which improves decision-making and compliance.

- Integration with other systems: Financial businesses can integrate BPA with their financial systems, like their CRMs and ERPs, to efficiently synchronise data. The result is faster data entry and reduced errors.

- Automatic reconciliation: BPA partially automates transaction reconciliation across different systems, like bank accounts, financial records, and credit card processors. As a result, financial discrepancies are detected faster and eliminated quicker, which reduces the time and effort spent in reconciliation.

- Improved compliance and auditability: Automated payment processing provides a clear and verifiable audit trail that’s easily reviewable by regulatory authorities. This way, financial businesses will have improved regulatory compliance and minimal risks of fines and other financial penalties.

- Cost savings: BPA reduces manual labour costs and resource allocation for payment processing and reconciliation tasks. As a result, financial businesses can prioritise resources for strategic and value-adding activities.

- Enhanced security: BPA tools employ security features that prevent unauthorised access or fraudulent transactions. So financial institutions can use BPA to improve their security systems and reduce the chances of fraud.

How Automation is Improving Finance Industry

The best way to illustrate the benefits of BPA for the financial industry is with an example. ‘Acme Finance’ is a small financial service provider that had a staff turnover, poor customer service, and was plagued with a high error rate. That was until they invested in BPA.

After implementing BPA, Acme Finance experienced an improved staff retention rate, their error rate fell by 90%, and their customer service response times were reduced by 50%. These benefits allowed Acme Finance to save time and resources on recruitment, minimise errors, and provide better customer service. These benefits totalled a more than 50% increase in productivity.

Other finance businesses achieved similar results. The Hackett Group discovered that finance organisations that adopt automation reduce errors by more than 50%. Other research also indicates that businesses can save up to 70% of their finance operating costs with automation solutions.

Business process automation has immense potential for the financial industry. Financial businesses can use it to reduce operating costs, automate data entry and other repetitive tasks, and save costs.

That being said, introducing BPA to your organisation won’t be easy. It will be a complex and time-consuming task, and you want to ensure you implement the right solutions. You may even need help. You can contact PowerbITs for a free consultation to introduce BPA to your financial business.